There are few things people care more about keeping private than the details of their personal finances. So when banking entered the digital world, there were major concerns around privacy, data and how customers could know their information was secure.

Today, there are more digital tools and opportunities for people and their money than ever. Thanks to financial institution apps like My Synovus and Chase Mobile®, digital payment systems including Venmo and PayPal, and digital currency such as bitcoin, the use of mobile banking went from an uneasy concept to a daily routine for most consumers.

But how can you ensure that customers know your platforms are secure? Also, how can you personalize emails and other communications to customers without going too far? Read on as we explain how Ansira has navigated these waters for some of our clients in the financial industry as well as how other companies are using similar best practices in the inbox.

Financial Offers in Email

Financial companies often want to widen the share of current customers’ wallets. Adding an additional product can help companies gain more revenue from the same customers as well as expand their brand position within the market. When trying to upsell the customer, it’s good to speak to them as someone familiar with your brand, but it may come across as overstepping if the marketing speaks directly to the fact that “we know what you have, get something else from us.”

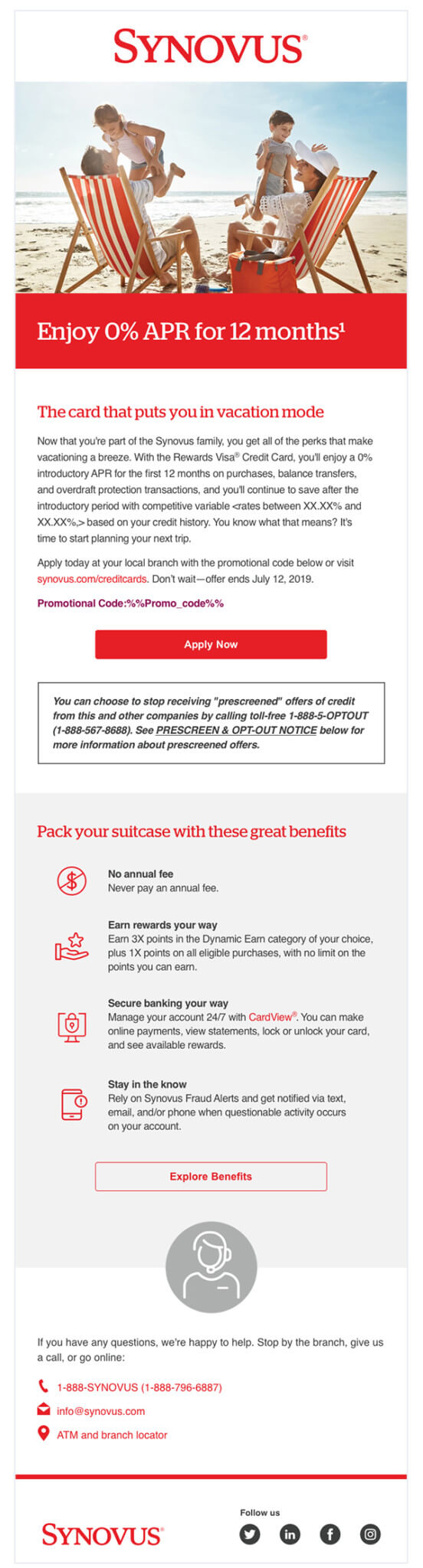

Synovus often positions their credit card offers to customers as an opportunity to “do more” with their brand. It’s a good way to say, “Hello, we know we have a good relationship with you, and we think this is an opportunity to make it even better” without overselling.

The hero content speaks to a new customer with “Now that you are part of the Synovus Family” while the secondary content highlights the card benefits, including security. And, speaking of security…

Security Online

Trust. It’s something that’s hard to earn and easy to lose. All digital marketers shudder at the words “data breach,” and so do your customers. Data breaches not only harm your reputation with current customers, but also with potential customers. It’s important to show customers you are a trusted partner with security icons and badges in email. It helps keep the email scannable and gives the customers the information that’s important in an easily digestible way.

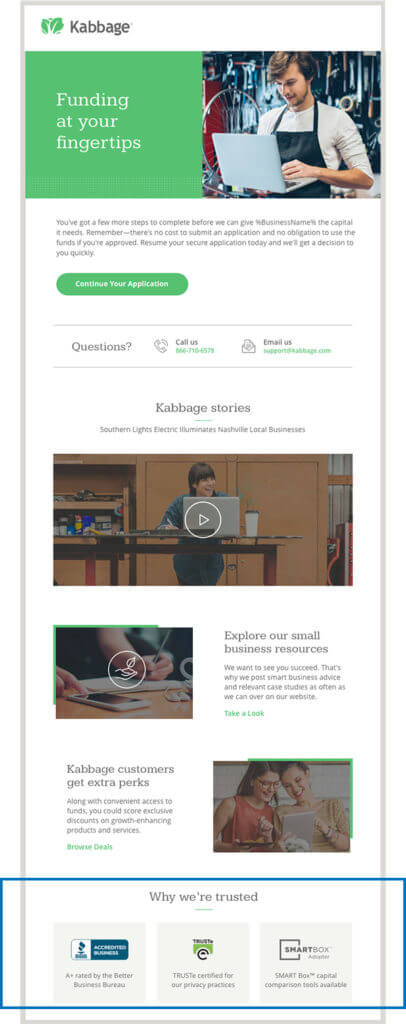

Kabbage is another Ansira client with a need to show their relationship with customers is one that can be trusted, especially as they aim to help small businesses get loans and fund projects.

Located at the bottom of the email, a customer can read through the benefits of Kabbage and feel confident clicking through to apply for a loan knowing the platform has the credentials to keep their data secure.

Personalization in Content

The digital marketer will say, “The more personalization, the better. The more you personalize, the better conversion rate you will see.” While that is true with segmentation and offer positioning, be careful giving too much away in the email channel as emails are really not a secure media.

Customers are wary of seeing their account details pasted where they are not expecting it. Hashing credentials is a good way to show customers that you are in fact the company they do business with without exposing their data. A good example of this can probably be found in your inbox. Similar to the below Bank of America example, financial companies bring through personal information in a secure way by simply using dynamic fields for your account/card name and last 4 digits of the account.

Another smart way to personalize content in a way that doesn’t come off “creepy” or risky is to talk specifically to the customer about the product they have without pulling in any account information inside the email.

This is a classic and legitimate way to increase conversion, and we leveraged this strategy to help our client Synovus tell the story of their revamped credit cards. We helped the brand gain a significant lift by using a highly dynamic email series that touched on seasonally relevant topics. Below are a few examples from this campaign and to get a more in depth look, see our case study.

These are just a few examples of how financial companies are successfully using sensitive information for their emails. When advising our many clients in the financial industry, we always encourage them to think about their campaigns from the eyes of their customers. What information would they be comfortable knowing that you know? What information borders on oversharing, especially in the inbox? And last, how do you keep your brand from seeming greedy? By keeping in mind these questions as well as the previous examples that use best practices, it’s easy to make a good impression while maintaining your customers’ trust.