Editor’s note: In mid-June, we we brought together some of our technology clients — Cisco, Sage, Citrix, and Red Hat — to discuss challenges and opportunities associated with market development fund (MDF) programs. We had lively debates and discussions, heard outside perspectives from Forrester and CDW, and shared program best practices. This is the first article in a series that captures our learnings and workshop highlights. Stay tuned for more to come.

—

Almost 20 years ago, the top global brands were companies such as Nokia, Marlboro, and AT&T. From 2000 to 2008, the list began to shift with the inclusion of Google. After 2008, other disruptors such as Apple, Facebook, and Amazon rocketed into the top 15, and today they remain in the top five (along with Microsoft).

How did these companies achieve such enormous growth? In part, with distributed sales models.

Channel partner support used to be defined by discounts and traditional media tactics. A third party was brought in to manage the process, but there was a “set it and forget it” mentality. Today, channel marketing budgets are often 10 times that of brand marketing budgets, and messages are broadcast across all media touchpoints, online and offline. That third party is now a true business partner, helping the brand design, structure, and manage the process.

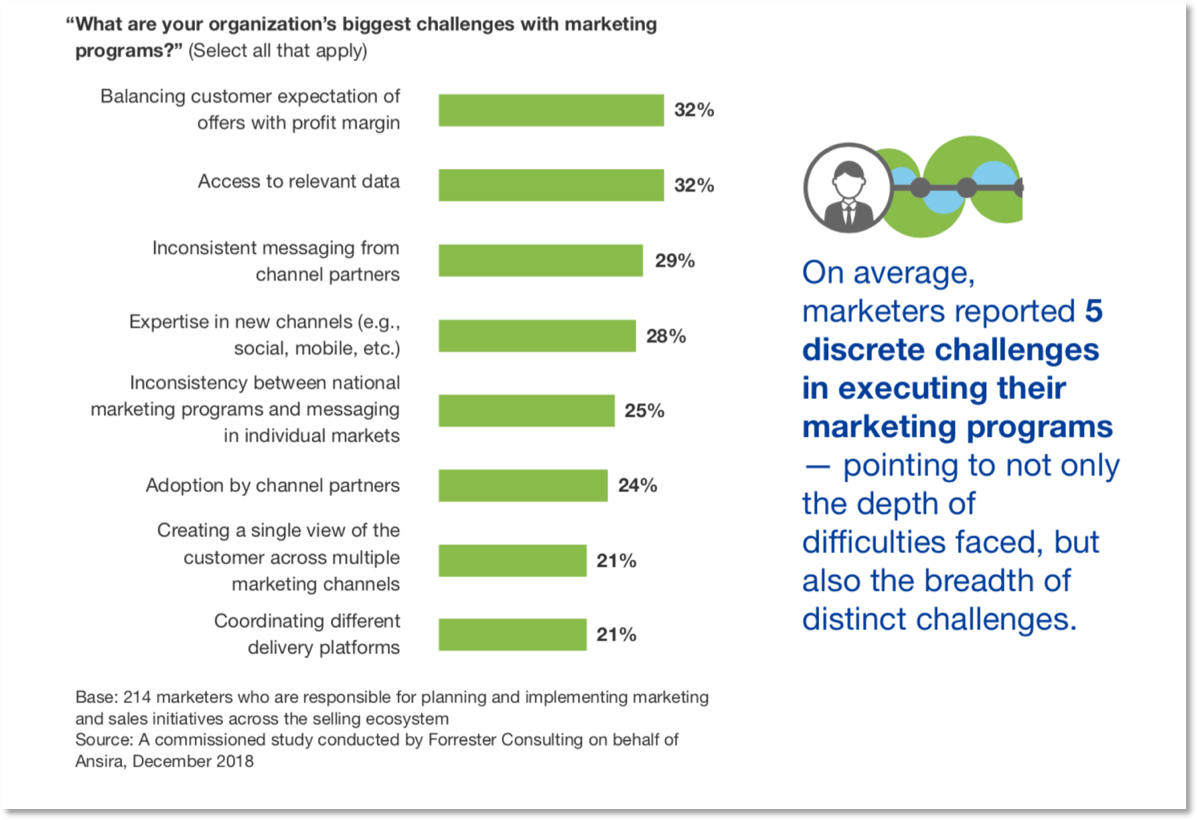

That’s not to say that brands don’t still struggle with channel marketing and partner management. Ansira commissioned a study by Forrester Consulting to uncover truths about multichannel marketing orchestration. Researchers surveyed more than 200 marketers responsible for planning and implementing initiatives across the selling ecosystem. Their answers revealed that inconsistent messaging from channel partners, inconsistency between national marketing programs and messaging in individual markets, and adoption from channel partners were among the biggest brand-to-local challenges.

Brands that connect channel marketing to sales outcomes are better able to address those challenges and show a correlation between business performance and distributed partner sales. SiriusDecisions defines these organizations as high performers. Using channel marketing metrics from the SiriusDecisions Command Center, information from more than 300 inquiries, and data from the 2017 Global CMO Study, the team at SiriusDecisions uncovered commonalities between these high-performing organizations:

- High performers allocated 17% of their total marketing budgets to channel marketing

- High performers invest 23% more in market development funds (MDFs) than low-growth organizations

- 70% growth achieved in channel marketing sourced revenue via partner digital marketing activities

The takeaway: Brands with distributed sales channels must work through the challenges that surfaced in our study with Forrester — with the right strategy, technology, and partner — because there’s a big payoff in the end.

Read other articles in our MDF workshop series: